A digital Transformation playbookBuild your conversational banking strategy

94% of leaders in the banking industry say their customers are more critical of customer engagement than ever. Digital conversations have the power to unlock real-time insights, operational efficiency, and customer satisfaction. Download to start building your conversational banking experience.

Benefits of conversational banking

“With messaging and automation, you can safely talk to your clients in their channel of choice and in the language of their heart. That’s how you gain true client intimacy.”

~ Carlos Moodley, Head of Group Conversational Banking at Capitec

Download now

Ready to download?

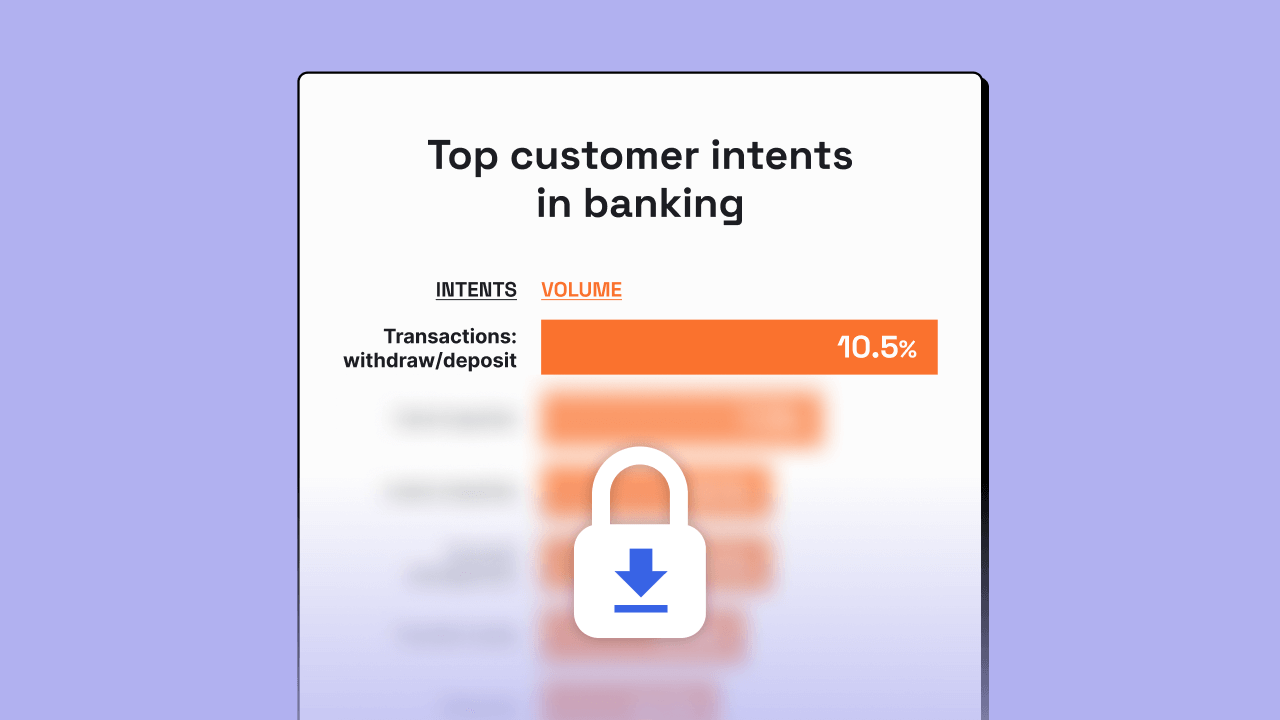

Unlock the top intents of banking customers

LivePerson powers more than 10 million banking interactions each year for the world’s biggest banks. Find out why…and how you can leverage our conversational technologies and strategies for your financial institution.