article

The future of banking: Conversational AI transforming customer experience in South Africa

Banking industry leader Capitec shares how they embraced emerging technologies without financial risks

February 12, 2024 • 4 minutes

Global banking in the digital age

Many banks worldwide are responding to the digital era by innovating and redefining their approaches. Digital transformation in banking is no longer a mere trend — it’s an essential strategy for staying competitive and relevant. It involves not only adopting new digital banking technologies but also rethinking customer touchpoints, interactions, and services.

Carlos Moodley’s tenure at Capitec marks a significant shift in banking customer engagement, with a focus on personalization, efficiency, and intuitive interactions. Partnering with LivePerson, they utilized the Conversational Flywheel™, a model that emphasizes continuous engagement and improvement through AI-driven conversations.

Implementing LivePerson’s Conversational Flywheel within Capitec’s banking system

Capitec’s journey to enhance customer experience led them to adopt LivePerson’s Conversational Flywheel. This framework isn’t just a set of ideas; it’s a dynamic process that combines conversational AI with human-centric interactions, optimizing customer satisfaction and business operating models.

The Conversational Flywheel comprises four key components:

- Understand: Delve into customer conversations to gain authentic, data-driven insights. Capitec used these customer data analytics to tailor their banking services more effectively.

- Connect: Reach customers across various digital platforms, ensuring consistent and integrated communication. Capitec’s use of different platforms like WhatsApp exemplifies this approach.

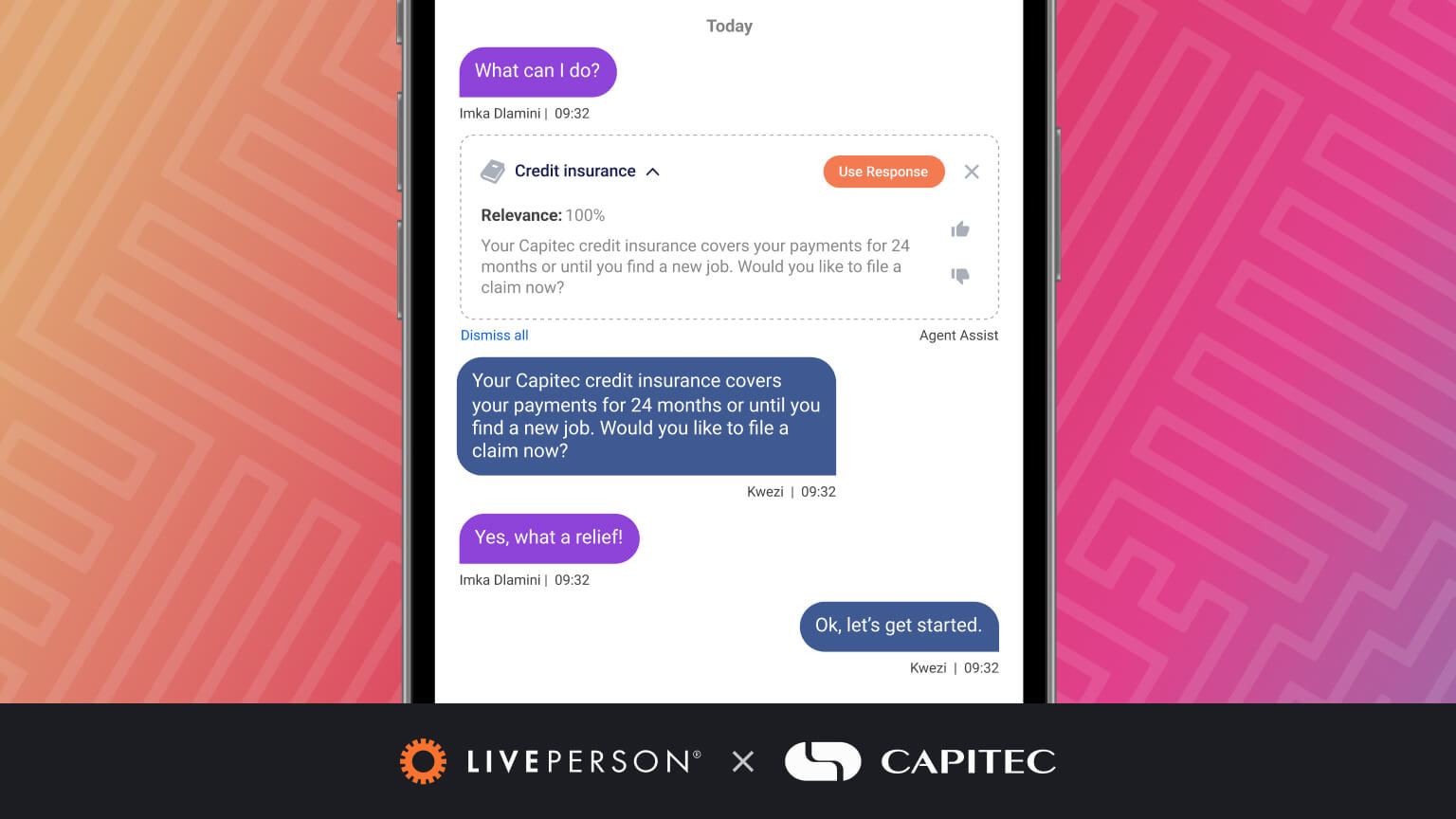

- Assist: Enhance customer support with artificial intelligence tools that empower agents to focus on critical interactions in new and innovative ways. Capitec leverages AI-driven tools and digital technologies to supercharge their agents, enabling them to concentrate on the most meaningful customer interactions.

- Automate: Introduce personalized automation to scale up services while maintaining a high quality of customer interaction. By deploying strategic automation, Capitec enhances service efficiency without compromising the personalized touch of their customer interactions.

For Capitec, the implementation of the Conversational Flywheel meant not only understanding their customers better but also providing personalized banking services on a much larger scale.

Harnessing the power of conversational data for the banking sector

Capitec leveraged LivePerson’s conversational intelligence tools to analyze their customer intent data, gaining deeper insights from their conversations across various platforms. This real-time, detailed feedback enabled Capitec to understand and meet customer needs more effectively.

Connecting with customers on their terms

Capitec’s emphasis on meeting customers on their preferred platforms transformed the way they interacted with the bank. For instance, integrating banking services on WhatsApp allowed customers to engage in banking transactions conveniently and securely in a channel they were already using every day. Not only did this make interactions with Capitec more convenient, it also created a more natural and intuitive experience for customers as they could use a channel they knew how to navigate.

Personalizing interactions with AI solutions

Capitec’s strategic use of artificial intelligence in customer interactions has been pivotal for the future of banking. By integrating customer information with LivePerson’s AI technology, they provided a more personalized banking experience, enhancing both efficiency and customer satisfaction.

The future of banking: A journey of continuous learning and automation

Capitec is committed to evolving their AI strategy. By continuously refining their approach based on customer interaction data, they are laying the groundwork for automating a broader range of services, making banking more seamless for customers.

Bringing it all together

Capitec’s conversational AI story is a testament to how technology can act as a competitive advantage in the future of banking. To dive deeper into this transformative journey and understand how Capitec is using conversational AI and digital transformation solutions to revolutionize customer interactions, watch the full webinar, available on-demand now.