Digital Banking Transformation strategiesDeliver quick wins with cost-effective Conversational Banking

With AI and digital technologies, financial institutions can transform business models and improve customer satisfaction. Discover Conversational Banking call reduction strategies essential to this digital banking transformation.

Reduce calls and move to messaging for a better customer experience in the digital journey

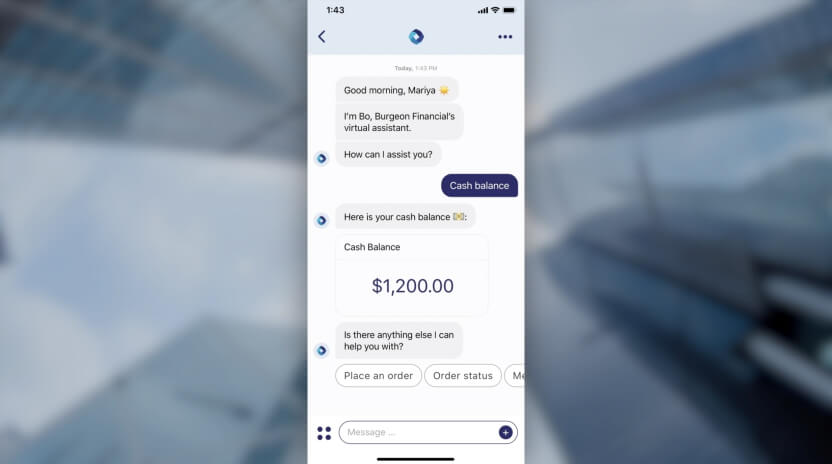

Personalization is one of the most important factors in delivering a satisfying online banking experience — something that 86% of customers say they want more of. LivePerson’s Conversational AI empowers the banking industry to deliver these personalized, customer-centric interactions and reduce inbound call volume, cutting costs and driving revenue.

Start the digital transformation by moving callers to mobile apps or messaging, giving them the at-your-service digital banking experience that meets them in the moment and beyond. Our guide details 7 ways a bank or credit union can do this, from IVR deflection to Proactive Messaging, using QR codes, conversational email management, Web Messaging, and Apple’s Message Suggest feature.

Interested in learning more about saving costs (and customers) with digital solutions like AI-powered call reduction and Conversational Banking? Drop your info in the form above to access our guide and start the transformation.